Why Regulated Industries Choose Managed IT: Compliance

- Fallon Mead

- Nov 14, 2025

- 14 min read

It's audit season, and regulated businesses across Florida and Georgia are receiving compliance review notices. A healthcare practice in Fort Lauderdale faces HIPAA scrutiny. A financial services firm in Atlanta gets a SOX audit notification. A legal office in Jacksonville receives bar association technology compliance requirements. Each realizes the same uncomfortable truth: their documentation is incomplete, their security measures are inconsistent, and they're not entirely confident their current IT setup meets regulatory requirements. Violations could mean penalties up to $1.5 million, not to mention the reputational damage that could devastate their business.

Meanwhile, across each of these cities, other practices in these same industries receive identical audit notices and feel completely confident. Their managed IT provider has been maintaining comprehensive documentation, implementing required security measures, and conducting regular compliance assessments. The audit becomes a routine validation rather than a source of anxiety.

This stark difference in regulatory confidence represents one of the most compelling reasons healthcare practices, financial services firms, and legal offices across Florida and Georgia are choosing managed IT services. In regulated industries, compliance isn't optional, it's essential to business survival.

Understanding the Compliance Challenge for Regulated Industries

Healthcare, financial services, and legal practices operate under some of the strictest regulatory frameworks in business. These regulations exist to protect sensitive information and ensure operational integrity, but they create significant complexity for businesses trying to maintain compliance.

The Regulatory Landscape

Healthcare Organizations must navigate:

HIPAA (Health Insurance Portability and Accountability Act): Protects patient health information with detailed security and privacy requirements.

HITECH (Health Information Technology for Economic and Clinical Health): Expands HIPAA requirements and increases penalties for violations.

State-Specific Regulations: Additional privacy and security requirements that vary by state.

Telehealth Requirements: Emerging regulations around remote patient care and data transmission

Financial Services Firms face requirements including:

FFIEC (Federal Financial Institutions Examination Council): Comprehensive IT examination standards for financial institutions

SOX (Sarbanes-Oxley Act): Financial reporting and internal controls requirements for public companies

GLBA (Gramm-Leach-Bliley Act): Privacy and security requirements for financial information

PCI DSS (Payment Card Industry Data Security Standard): Requirements for organizations handling credit card transactions.

State Banking Regulations: Additional requirements specific to state banking authorities.

Legal Practices must maintain:

Attorney-Client Privilege Protection: Stringent confidentiality requirements for all client communications

Bar Association Technology Standards: State bar technology competency requirements

Data Breach Notification Laws: Requirements for disclosure of security incidents

Electronic Discovery Requirements: Proper retention and production of electronic records

The Compliance Complexity Challenge

What makes regulatory compliance particularly challenging for growing businesses is the technical depth required across multiple domains:

Security Implementation: Regulations require specific technical controls, encryption, access management, audit logging, network segmentation, which demand specialized expertise to implement properly.

Documentation Requirements: Compliance demands comprehensive documentation of policies, procedures, risk assessments, and security measures. Research shows this documentation burden consumes 40-60% of compliance-related effort.

Continuous Monitoring: Regulations require ongoing monitoring and regular assessment of security measures. A one-time implementation isn't sufficient; compliance is a continuous process.

Incident Response: Organizations must have documented procedures for detecting, responding to, and reporting security incidents. The complexity of incident response often exceeds internal capabilities.

Training and Awareness: Staff training on security and privacy requirements is mandatory, requiring regular updates as regulations and threats evolve.

Vendor Management: Third-party vendors with access to sensitive data must be assessed and managed appropriately, adding another layer of compliance complexity.

For growing businesses in regulated industries, maintaining this level of compliance sophistication internally is challenging and expensive. This is where managed IT services provide transformative value.

Why Managed IT Services Excel at Compliance Management

Managed service providers specializing in regulated industries bring several critical advantages to compliance management:

Dedicated Compliance Expertise

While a general IT professional might understand basic security concepts, compliance requires specialized knowledge of regulatory frameworks, technical controls, and documentation requirements. Industry research indicates that IT professionals with comprehensive compliance expertise command salaries of $110,000-$160,000 annually, beyond the budget of most growing businesses.

Managed service providers maintain this expertise as a core business capability:

Regulatory specialists stay current with evolving requirements across HIPAA, FFIEC, SOX, and other frameworks.

Technical security experts implement controls that meet regulatory standards.

Documentation Personnel create and maintain comprehensive compliance documentation.

Audit preparation specialists know exactly what regulators look for and ensure readiness.

This depth of expertise, requiring multiple full-time specialists internally, becomes accessible at a fraction of the cost through managed services.

Comprehensive Risk Assessment and Management

Compliance frameworks require formal risk assessments identifying threats to sensitive information and implementing appropriate safeguards. Studies show that organizations using managed services for risk assessment demonstrate substantially more comprehensive analysis than those attempting risk assessment internally.

Professional risk assessment includes:

Threat identification across technical, physical, and administrative domains

Vulnerability analysis of systems, processes, and controls

Impact evaluation of potential security incidents on business operations

Risk mitigation planning with prioritized remediation recommendations.

Ongoing reassessment as business operations and threat landscapes evolve.

This systematic approach ensures nothing is overlooked and resources are allocated to areas of greatest risk, a level of thoroughness difficult to achieve with limited internal resources.

Implementation of Required Security Controls

Regulations specify numerous technical security controls that must be implemented and maintained:

Access Management: Industry research shows that improperly configured access controls represent one of the most common compliance failures. Managed services implement sophisticated access management including:

Role-based access controls limiting data access to business necessity.

Multi-factor authentication for all system access

Regular access reviews and automated deprovisioning

Privileged account management and monitoring

Encryption Requirements: HIPAA, FFIEC, and other regulations require encryption of sensitive data at rest and in transit. Proper encryption implementation demands technical expertise to balance security with operational functionality.

Audit Logging: Compliance requires comprehensive logging of system access and activities. Studies indicate organizations with managed IT services maintain significantly more complete audit logs than those managing logging internally, providing crucial evidence during audits or incident investigations.

Network Security: Proper network segmentation, firewall configuration, and intrusion detection require specialized knowledge. Managed service providers implement these controls following industry best practices and regulatory guidance.

Patch Management: Timely application of security patches is a fundamental compliance requirement. Research shows managed services maintain substantially better patch compliance than internal IT teams stretched across multiple responsibilities.

Documentation and Policy Development

Perhaps no aspect of compliance is more time-consuming than documentation. Regulations require extensive written policies, procedures, and evidence of implementation.

Managed service providers create and maintain:

Comprehensive policies covering all required security and privacy domains.

Detailed procedures for system management, incident response, and data handling

Risk assessment documentation showing systematic analysis and mitigation.

Security incident logs provide evidence of monitoring and response.

Training records demonstrate staff awareness and education.

Vendor management documentation for business associates and third parties

Technical security documentation showing implementation of required controls.

Industry data indicates that organizations using managed services for compliance

documentation spend 50-70% less time on documentation activities while maintaining substantially more complete records.

Audit Support and Preparation

When auditors arrive, having comprehensive documentation and confident expertise makes the difference between smooth validation and stressful interrogation.

Managed service providers with compliance specialization:

Pre-audit assessments identify potential issues before official audits.

Documentation preparation ensures all required evidence is organized and accessible.

Technical interviews with auditors demonstrating control implementation.

Remediation planning for any findings or recommendations

Continuous readiness rather than last-minute scrambling before audits

Healthcare practices and financial firms using managed services consistently report substantially smoother audit experiences compared to managing compliance internally.

Industry-Specific Compliance Benefits

Healthcare Practices and HIPAA Compliance

Healthcare organizations face particular challenges with HIPAA compliance, which encompasses both privacy and security requirements for protected health information (PHI).

Electronic Health Records Security: Modern healthcare practices rely on electronic health record (EHR) systems containing sensitive patient information. Proper EHR security requires:

Secure authentication and access controls

Audit logging of all PHI access.

Encryption for data at rest and in transit

Business associate agreements with EHR vendors

Disaster recovery and business continuity planning

Research indicates that healthcare practices with managed IT services experience significantly fewer EHR security incidents and maintain better HIPAA compliance than those managing EHR security internally.

Telehealth Platform Management: The rapid expansion of telehealth introduces new compliance considerations. Telehealth platforms must maintain HIPAA compliance while enabling remote patient care, requiring specialized technical knowledge of:

Secure video conferencing solutions

Patient portal security and access management

Remote prescription and documentation workflows

Integration with existing EHR systems

Patient privacy in remote environments

Studies show that healthcare organizations implementing telehealth with managed IT support achieve better security outcomes and faster deployment than those attempting telehealth implementation with limited internal IT resources.

Mobile Device Management: Healthcare staff increasingly use mobile devices to access patient information, creating significant security challenges. Proper mobile device management includes:

Device encryption and remote wipe capabilities

Secure access to clinical applications

Segregation of personal and professional data

Lost or stolen device procedures

Bring-your-own-device (BYOD) policy enforcement.

Healthcare organizations using managed services for mobile device management report substantially better control over mobile access to PHI compared to practices attempting device management internally.

Incident Response and Breach Notification: HIPAA requires specific procedures for detecting, investigating, and reporting potential security incidents. The complexity of breach determination and notification requirements often exceeds internal capabilities.

Managed service providers specializing in healthcare IT provide:

24/7 security monitoring for potential incidents

Documented incident response procedures.

Forensic investigation capabilities

Breach determination guidance

Notification support if breaches occur.

Regulatory reporting assistance

Financial Services and Regulatory Compliance

Financial services organizations face a complex web of regulatory requirements designed to protect financial information and ensure operational integrity.

Multi-Layered Regulation: Financial firms often must comply with multiple frameworks simultaneously, FFIEC guidelines, state banking regulations, SOX requirements for public companies, and PCI DSS for payment processing. This regulatory complexity demands comprehensive compliance expertise.

Research shows financial services firms using managed IT services maintain substantially better compliance across multiple regulatory frameworks compared to those attempting compliance management with general IT staff.

Information Security Programs: FFIEC and other financial regulations require formal information security programs including:

Board and management oversight.

Risk assessment and management.

Security controls implementation

Vendor management and oversight

Incident response planning

Customer education and awareness

Regular testing and monitoring

The comprehensiveness required for financial services information security programs typically exceeds what growing firms can maintain internally. Managed services provide the systematic approach and documentation necessary for regulatory satisfaction.

Audit and Examination Preparation: Financial institutions face regular examinations by regulatory authorities. These examinations scrutinize IT security and compliance programs in detail.

Financial firms using managed IT services for compliance preparation consistently report more favorable examination outcomes. The comprehensive documentation, technical expertise, and systematic approach provided by specialized MSPs align well with examiner expectations.

Cybersecurity Assessments: Financial regulations increasingly require formal cybersecurity assessments evaluating an institution's resilience against cyber threats. These assessments demand sophisticated technical analysis and security expertise.

Managed service providers conduct comprehensive cybersecurity assessments covering:

External vulnerability scanning and penetration testing

Internal security control evaluation

Third-party vendor security assessment

Incident response capability testing

Business continuity and disaster recovery validation

Industry data indicates financial institutions with managed IT services demonstrate substantially stronger cybersecurity postures and better assessment results.

Legal Practices and Confidentiality Requirements

Law firms face unique technology challenges balancing client confidentiality requirements with operational efficiency needs.

Attorney-Client Privilege Protection: The fundamental confidentiality of attorney-client communications demands stringent security measures. Any breach of client information can result in ethical violations, professional liability, and reputational damage.

Legal practices using managed IT services for confidentiality protection implement:

Comprehensive access controls limiting information access.

Encryption of all client communications and files

Secure client portals for document exchange

Audit logging of all client file access.

Physical and logical segregation of client matters

Research shows law firms with professional IT management experience substantially fewer confidentiality breaches compared to those managing technology security informally.

Electronic Discovery Management: Modern legal practice requires sophisticated electronic discovery (e-discovery) capabilities for litigation support. Proper e-discovery management demands:

Comprehensive data retention policies

Legal Hold Procedures

Document preservation systems.

Search and production capabilities.

Chain of custody documentation

The technical complexity of e-discovery often exceeds the capabilities of law firms without specialized IT support. Managed service providers with legal industry experience provide the systems and procedures necessary for effective e-discovery management.

Cloud Ethics and Security: State bar associations increasingly issue guidance on attorney use of cloud services, requiring lawyers to understand security implications of cloud platforms. This creates compliance complexity for legal practices.

Managed service providers specializing in legal IT navigate these requirements by:

Vetting cloud platforms for legal practice suitability

Implementing security controls meeting bar association standards

Maintaining business associate agreements where required

Providing documentation of security measures

Ensuring compliance with state-specific requirements

Law firms using managed services for cloud security report greater confidence in regulatory compliance and client confidentiality protection.

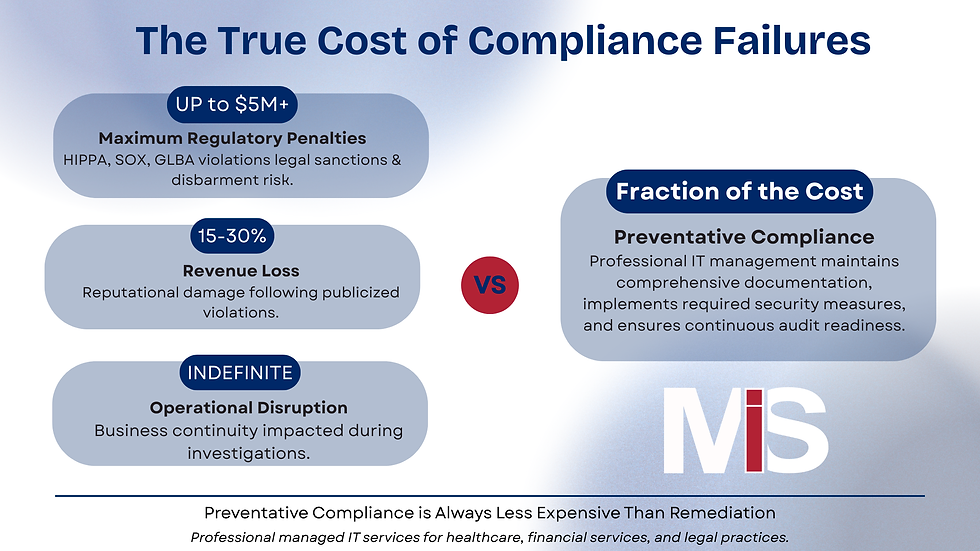

The Cost of Compliance Failure

Understanding the consequences of compliance failures underscores the value of professional compliance management:

Financial Penalties

Regulatory penalties for compliance violations can be severe:

HIPAA Violations: Penalties range from $100 to $50,000 per violation, with annual maximum penalties of $1.5 million per violation category. Research indicates the average HIPAA settlement exceeds $2.5 million.

Financial Services Violations: Banking regulatory penalties vary by severity but frequently reach hundreds of thousands to millions of dollars. Public disclosure of violations compounds monetary impact through reputational damage.

Legal Professional Violations: While bar associations don't typically impose direct financial penalties, professional liability claims for confidentiality breaches can result in substantial damages and increased malpractice insurance costs.

Reputational Damage

Beyond financial penalties, compliance violations create lasting reputational damage:

Patient or client loss due to trust erosion

Negative publicity affects practice growth.

Difficulty attracting qualified staff concerned about professional liability.

Increased scrutiny from regulators for future compliance

Studies indicate that businesses experiencing publicized compliance failures see revenue declines averaging 15-30% in subsequent years, far exceeding the cost of proper compliance management.

Operational Disruption

Compliance investigations and remediation efforts create significant operational disruption:

Management time devoted to regulatory response

Disruption of normal business operations during investigations

Cost of external legal counsel and consultants

Staff morale impact from negative scrutiny

Implementation of corrective action plans

Organizations that have experienced compliance failures consistently report that preventive compliance management would have been substantially less expensive and disruptive than remediation efforts.

How Managed IT Services Simplify Compliance

For healthcare practices, financial services firms, and legal offices across Florida and Georgia, managed IT services transform compliance from overwhelming burden to manageable business process.

Systematic Approach

Rather than reactive responses to compliance requirements, managed service providers implement systematic approaches:

Initial Assessment: Comprehensive evaluation of current compliance status, identifying gaps and prioritizing remediation.

Remediation Planning: Structured implementation plan addressing identified gaps with clear timelines and responsibilities.

Ongoing Monitoring: Continuous assessment ensuring compliance measures remain effective as business operations and regulations evolve.

Regular Reporting: Clear documentation of compliance status, activities, and any concerns requiring attention.

This systematic approach provides confidence that compliance is professionally managed rather than hoping nothing is missed.

Integration with Business Operations

Effective compliance doesn't exist separately from business operations—it must be integrated into daily workflows and procedures.

Managed service providers with industry experience integrate compliance seamlessly:

Security measures that protect without hindering operational efficiency

User-friendly systems encourage proper security practices.

Automated monitoring reduces administrative burden.

Clear procedures aligned with business workflows

Staff training that builds security awareness naturally

Research shows organizations with well-integrated compliance programs demonstrate better adherence and fewer security incidents than those where compliance feels burdensome and separate from normal operations.

Scalability for Growth

As businesses grow, adding locations, staff, or services, compliance requirements scale accordingly. Managed IT services provide compliance scalability that internal resources struggle to match.

Growing organizations benefit from:

Standardized security implementations across multiple locations

Consistent compliance procedures as staff increases.

Expanded capabilities (like telehealth) with compliance built in

Geographic expansion without recruiting compliance staff in each location.

New service offers with compliance requirements already addressed.

Healthcare practices and financial firms using managed services consistently report that growth becomes easier when compliance is professionally managed rather than creating additional internal burden.

Geographic Considerations: Florida and Georgia Markets

Healthcare practices and financial services firms across Florida and Georgia face specific regulatory considerations affecting compliance requirements.

State-Specific Healthcare Regulations

Beyond federal HIPAA requirements, Florida and Georgia maintain state-specific healthcare privacy and security regulations. Managed service providers with regional experience navigate these state requirements effectively, ensuring compliance with both federal and state frameworks.

Financial Services Regulatory Landscape

Financial institutions in Florida and Georgia face oversight from state banking departments with specific examination standards and requirements. Regional MSPs understand these state-specific requirements alongside federal frameworks like FFIEC.

Professional Liability Considerations

Florida and Georgia bar associations maintain specific technology competency requirements for attorneys. Regional managed service providers understand these state bar standards and implement solutions meeting professional responsibility requirements.

The MiS Approach: Compliance-Focused Managed IT

At MiS, we understand that for healthcare practices, financial services firms, and legal offices, compliance isn't just an IT issue, it's a business imperative affecting your ability to operate and serve clients.

Industry-Specific Expertise

Our team maintains deep expertise in healthcare, financial services, and legal technology requirements. This specialized knowledge ensures we understand not just general security principles but the specific regulatory frameworks affecting your industry.

Comprehensive Compliance Services

We provide complete compliance support including:

Risk assessments following regulatory frameworks.

Security implementation meeting industry standards

Documentation ready for audits and examinations

Incident response procedures and support

Staff training on security and privacy requirements

Audit preparation reduces examination anxiety.

Transparent Compliance Processes

We believe you should understand your compliance status clearly. Our reporting provides straightforward information about your compliance posture, any concerns requiring attention, and documentation of all compliance activities.

No-Contract Confidence

Our month-to-month service model reflects our confidence in the value we deliver. If our compliance management doesn't meet your expectations and requirements, you're not locked into long-term commitments.

Common Compliance Questions

"How do we know managed services will maintain compliance properly?"

Reputable managed service providers with industry specialization maintain compliance as a core business capability, their reputation and client retention depend on effective compliance management. Request references from other healthcare practices or financial firms they serve.

"What happens if there's a compliance violation despite using managed services?"

Professional MSPs maintain comprehensive documentation showing proper implementation of required controls. This documentation demonstrates good faith compliance efforts, which regulators consider when determining penalties.

"Can we still use our existing systems and vendors?"

Managed service providers work with your existing EHR systems, financial platforms, and other applications, adding security and compliance controls rather than requiring complete technology replacement.

"How involved do we need to be in compliance management?"

While the MSP oversees technical implementation and documentation, you maintain responsibility for business operations and policy decisions. Effective compliance requires partnership between your business knowledge and the MSP's technical expertise.

Taking the Next Step: Compliance Assessment

If you're concerned about your current compliance posture or want confidence that you're meeting all regulatory requirements, a comprehensive compliance assessment provides clarity.

Comprehensive Compliance Evaluation

A professional compliance assessment examines:

Current security controls against regulatory requirements

Documentation gaps that could create audit concerns

Risk factors requiring mitigation.

Incident response capabilities and procedures

Staff awareness of security and privacy requirements

Vendor management for business associates and third parties

Prioritized Remediation Planning

Assessment findings translate into clear action plans:

Critical gaps requiring immediate attention.

Important improvements for regulatory confidence

Best practice enhancements strengthening security posture.

Timeline and budget estimates for implementation

Ongoing Compliance Management

For organizations choosing managed services, assessment findings inform systematic compliance implementation providing long-term regulatory confidence.

Ready to Simplify Compliance?

Healthcare practices, financial services firms, and legal offices across Fort Lauderdale, Augusta, Jacksonville, Miami, Tampa, Orlando, and Atlanta are discovering that professional compliance management through managed IT services provides better results with less stress than attempting compliance internally.

Don't let compliance anxiety distract from serving your patients, clients, and customers. Proper compliance management should provide confidence, not consume your attention with worry about audits and violations.

Schedule Your Compliance Readiness Assessment

Our compliance experts will evaluate your current security posture, identify regulatory gaps, and provide a clear roadmap for achieving and maintaining compliance confidence.

During your assessment, we'll:

Evaluate compliance status across relevant regulatory frameworks.

Identify security gaps creating regulatory risk.

Review documentation for audit readiness.

Assess incident response capabilities.

Provide clear recommendations with priorities and timelines.

Contact MiS today to schedule your complimentary compliance assessment and discover how managed IT services can transform regulatory compliance from burden to business advantage.

Frequently Asked Questions

How long does it take to achieve full compliance?

Timeline varies based on current status and gaps identified. Organizations with significant gaps typically achieve substantial compliance within 90-120 days, with documentation and fine-tuning continuing for several months.

What if we've never had a formal compliance program?

Starting from baseline is common for growing practices. Professional MSPs provide structured implementation ensuring nothing critical is missed while prioritizing high-risk areas first.

Can managed services help if we fail an audit?

Yes, MSPs experienced in compliance remediation help organizations address audit findings systematically, implement required corrections, and establish programs preventing future violations.

How do we know our MSP understands our specific regulatory requirements?

Request information about their industry experience, compliance certifications, and references from similar organizations. Industry-specialized MSPs should demonstrate clear expertise in your regulatory framework.

What ongoing involvement is required for compliance management?

You'll participate in quarterly compliance reviews, policy decisions, and staff training. The MSP handles technical implementation, monitoring, and documentation, substantially reducing your compliance burden while maintaining your appropriate oversight.

MiS specializes in compliance-focused managed IT services for healthcare practices, financial services firms, and legal offices across Florida and Georgia. Our systematic approach transforms regulatory compliance from overwhelming burden to manageable confidence.

Comments